Not known Incorrect Statements About Real Estate Reno Nv

Not known Incorrect Statements About Real Estate Reno Nv

Blog Article

See This Report on Real Estate Reno Nv

Table of ContentsReal Estate Reno Nv - The Facts4 Easy Facts About Real Estate Reno Nv DescribedReal Estate Reno Nv - The FactsUnknown Facts About Real Estate Reno NvGetting My Real Estate Reno Nv To WorkRumored Buzz on Real Estate Reno Nv

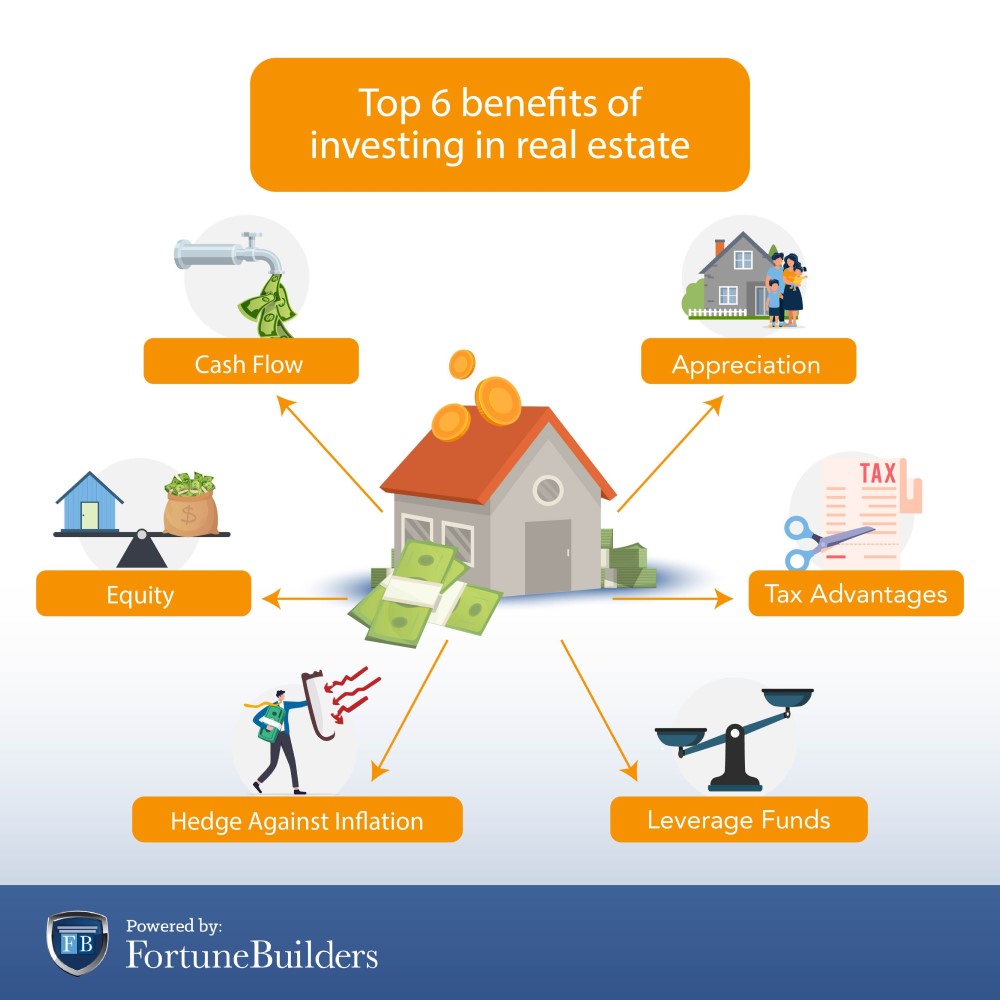

The benefits of buying realty are various (Real Estate Reno NV). With appropriate assets, financiers can take pleasure in foreseeable money circulation, exceptional returns, tax advantages, and diversificationand it's possible to leverage realty to build wide range. Considering buying property? Here's what you need to learn about property advantages and why property is thought about an excellent investment.

The benefits of investing in genuine estate include easy revenue, stable cash money flow, tax obligation benefits, diversity, and take advantage of. Actual estate financial investment trust funds (REITs) provide a way to spend in real estate without having to have, operate, or finance properties.

Actual estate worths often tend to enhance over time, and with a great investment, you can transform a revenue when it's time to market. As you pay down a home mortgage, you build equityan possession that's part of your net well worth. And as you build equity, you have the take advantage of to purchase more buildings and increase cash flow and riches also more.

Realty has a lowand in some cases negativecorrelation with other significant possession classes. This implies the enhancement of actual estate to a portfolio of diversified properties can decrease profile volatility and offer a greater return per system of threat. Utilize is making use of numerous economic instruments or borrowed funding (e.

Real Estate Reno Nv Things To Know Before You Buy

As economic climates increase, the demand for genuine estate drives rents greater. This, subsequently, converts into higher funding values. Therefore, realty has a tendency to maintain the purchasing power of funding by passing several of the inflationary stress on to lessees and by integrating a few of the inflationary pressure in the kind of resources appreciation.

There are several manner ins which owning realty can safeguard against inflation. Initially, building values might rise greater than the rate of rising cost of living, bring about resources gains. Second, rental fees on investment buildings can boost to maintain up with inflation. Ultimately, buildings financed with a fixed-rate finance will certainly see the loved one amount of the regular monthly home mortgage payments drop over time-- as an example $1,000 a month as a check here fixed settlement will certainly become much less burdensome as rising cost of living wears down the buying power of that $1,000.

Nevertheless, one can benefit from selling their home at a price more than they paid for it. And, if this does happen, you might be liable to pay tax obligations on those gains. Regardless of all the advantages of purchasing realty, there are disadvantages. Among the main ones is the lack of liquidity (or the family member trouble in converting a possession right into cash and cash money right into a possession).

The Basic Principles Of Real Estate Reno Nv

Yet among the most basic and most usual techniques is simply acquiring a home to lease out to others. So why invest in property? Nevertheless, it needs a lot more job than just clicking a few buttons to spend in a shared fund or supply. The fact is, there are several realty advantages that make it such a preferred choice for skilled financiers.

Yet the rest goes to paying for the finance and building equity. Equity is the worth you have in a residential property. It's the difference next between what you owe and what the dwelling or land deserves. Gradually, normal payments will ultimately leave you possessing a building complimentary and clear.

The Ultimate Guide To Real Estate Reno Nv

Any person that's shopped or loaded their container recently understands exactly how inflation can damage the power of hard-earned cash money. Among the most underrated real estate advantages is that, unlike numerous conventional financial investments, real estate worth often tends to go up, even during times of noteworthy inflation. Like other essential possessions, property usually maintains worth and can as a result work as an exceptional location to invest while greater rates gnaw the gains of numerous other financial investments you might have.

Recognition refers to cash made when the total worth of a property rises in between the moment you buy it and the moment you sell it. For real estate, this can imply significant gains as a result of the normally high costs of the properties. However, it's essential to bear in mind recognition is an one-time point and only gives cash when you market, not along the road.

As stated previously, capital is the cash that begins a regular monthly or yearly basis as a result of having the residential or commercial property. Generally, this is what's left over after paying all look at these guys the needed costs like mortgage settlements, repair services, taxes, and insurance. Some residential or commercial properties might have a substantial capital, while others might have little or none.

Not known Incorrect Statements About Real Estate Reno Nv

Brand-new financiers might not absolutely recognize the power of utilize, but those who do unlock the possibility for huge gains on their investments. Typically speaking, leverage in investing comes when you can have or manage a bigger amount of possessions than you might or else pay for, via the use of credit report.

Report this page